The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme aimed at securing the future of a girl child in India. Launched in 2015 under the Beti Bachao Beti Padhao initiative, the scheme offers a higher interest rate compared to regular savings accounts and provides tax benefits under Section 80C of the Income Tax Act. To help parents and guardians better manage their investments in this scheme, using a Sukanya Samriddhi Yojana calculator in Excel can simplify the process and ensure accurate calculations.

In this blog post, we will cover everything you need to know about the Sukanya Samriddhi Yojana calculator in Excel, how it works, how to use it, and why it’s an essential tool for managing this investment.

What is Sukanya Samriddhi Yojana (SSY)?

Before diving into the details of the Sukanya Samriddhi Yojana calculator, let’s first understand the scheme itself.

The Sukanya Samriddhi Yojana is a small savings scheme specifically designed for the welfare of a girl child. The account can be opened in the name of a girl child who is below 10 years of age, and a parent or guardian can operate the account on behalf of the child. The scheme offers several benefits:

- Higher Interest Rate: The interest rate on SSY is higher than that of regular savings accounts, making it an attractive option for long-term savings.

- Tax Benefits: The contributions made to the scheme are eligible for tax deduction under Section 80C of the Income Tax Act, and the interest earned is tax-free.

- Safe and Secure: Being backed by the Government of India, the scheme is risk-free, offering guaranteed returns.

- Long-Term Investment: The account matures after 21 years from the date of opening or upon the marriage of the girl child after reaching the age of 18 years.

Also Read – Aadhar Card PVC Apply Online at UIDAI

Also Read – Atul Maheshwari Scholarship Admit Card Download

Also Read – PMKVY के लिए आवेदन कैसे करें

Why Use a Sukanya Samriddhi Yojana Calculator in Excel?

Using a Sukanya Samriddhi Yojana calculator in Excel is an efficient way to track and manage your investment. Here are some key reasons why it’s beneficial:

- Accurate Calculations: Excel allows for precise calculations based on the contributions made, the interest rate, and the tenure. It eliminates the risk of manual errors.

- Customizable: You can modify the calculator to suit your specific needs, such as adjusting the monthly contributions or changing the interest rate based on government updates.

- Easy to Use: Excel is user-friendly, and you don’t need to be an expert to use it. It provides clear results and is easy to understand.

- Track Investment Growth: With Excel, you can easily track the growth of your investment over time, helping you make informed decisions about your savings.

Key Components of a Sukanya Samriddhi Yojana Calculator

A typical Sukanya Samriddhi Yojana calculator in Excel should include the following key components:

- Principal Amount: The initial investment or the amount you plan to deposit.

- Monthly Contributions: The amount you plan to contribute each month to the SSY account.

- Interest Rate: The interest rate applicable to the scheme, which is updated quarterly by the government.

- Investment Period: The duration for which you plan to invest in the SSY, typically 21 years.

- Maturity Amount: The total amount at the end of the investment period, including principal and interest.

How to Create a Sukanya Samriddhi Yojana Calculator in Excel

Creating a Sukanya Samriddhi Yojana calculator in Excel is simple and can be done by following these steps:

Step 1: Set Up the Excel Sheet

- Open a new Excel workbook.

- Label the following columns:

- Year: To represent each year of the investment period.

- Monthly Contribution: The amount you contribute each month.

- Interest Rate: The applicable interest rate for that year.

- Cumulative Amount: The total amount accumulated after each year.

- Interest Earned: The interest accrued during the year.

- Total Amount at Maturity: The final amount at the end of the investment period.

Step 2: Input the Initial Values

- In the first row, input the following details:

- Principal Amount: Enter the initial amount you want to invest in the SSY account.

- Monthly Contribution: Enter the amount you plan to contribute each month.

- Interest Rate: Input the current interest rate (for example, 7.6%).

- Investment Period: Enter the duration of the investment (typically 21 years).

- Set up the first year with the Principal Amount and the Interest Rate.

Step 3: Apply Formulas

In the subsequent rows, you need to apply formulas to calculate the cumulative amount, interest earned, and the total amount at maturity.

- Interest Earned: This can be calculated using the formula:

= (Cumulative Amount + (Monthly Contribution * 12)) * (Interest Rate / 100). - Cumulative Amount: The formula to calculate the cumulative amount is:

= Previous Year Cumulative Amount + Monthly Contribution * 12 + Interest Earned. - Total Amount at Maturity: This will be the final value in the last row after 21 years.

Step 4: Adjust for Changes in Interest Rates

Since the interest rate for the Sukanya Samriddhi Yojana is updated quarterly, you may want to update the interest rate every year or quarter in your Excel sheet. This can be done by adjusting the interest rate column for each year.

Step 5: Final Output

Once you have completed the Excel sheet, it will automatically calculate the total maturity amount at the end of the investment period based on your inputs. This will help you visualize how your investment grows over time and plan accordingly.

Also Read – Indiramma Atmiya Bharosa 2025: How to Apply And Check Eligibility

Also Read – Railway Recruitment Board Exam RRB Group D Apply Online 2025

Also Read – Anganwadi Supervisor Vacancy 2025 Apply Online Now

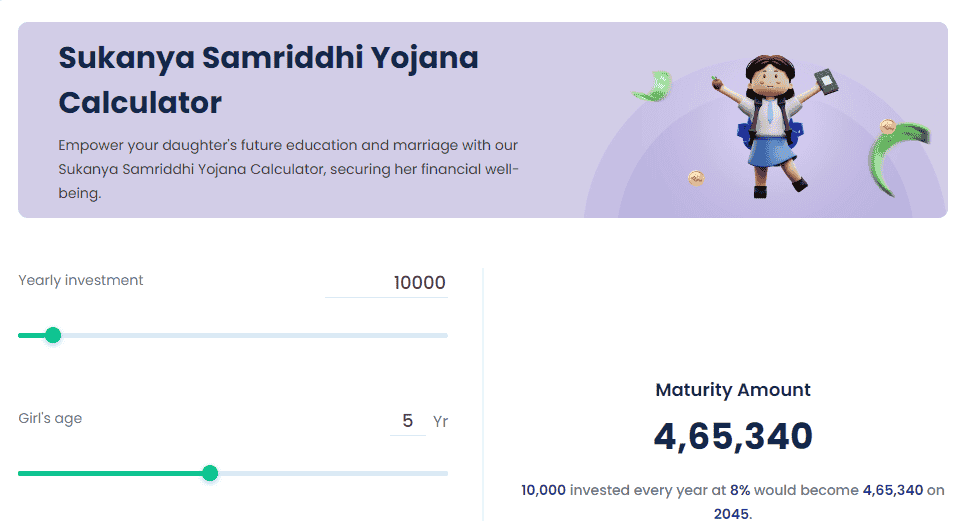

Example of Sukanya Samriddhi Yojana Calculation in Excel

Let’s say you invest ₹50,000 initially and contribute ₹1,000 every month to the SSY account at an interest rate of 7.6% for 21 years. Using the Sukanya Samriddhi Yojana calculator in Excel, the final maturity amount will be calculated after 21 years, taking into account the interest accrued each year.

Benefits of Using Excel for SSY Calculation

- Detailed Tracking: Excel provides a detailed breakdown of your investment, showing how much you have contributed and how much interest you’ve earned each year.

- Forecasting: You can easily forecast the maturity amount based on different scenarios, such as increasing or decreasing your monthly contribution or changing the interest rate.

- Customizable: The calculator can be customized to your specific needs, allowing you to add features like tax calculations or early withdrawal scenarios.

- Easy to Update: You can easily update the interest rate or contribution amount if there are any changes, ensuring your calculations remain accurate.

Things to Remember While Using the Sukanya Samriddhi Yojana Calculator

- Interest Rate Changes: The interest rate is revised every quarter by the Government of India. Ensure that you update the rate in your Excel sheet accordingly.

- Maximum Contribution Limit: The maximum annual contribution to the SSY account is ₹1.5 lakh. Make sure your contributions do not exceed this limit.

- Maturity Period: The SSY account matures after 21 years, but you can make partial withdrawals after the girl child turns 18.

Also Read – NREGA Job Card List Jharkhand 2025 Job Card jharkhand Download

Also Read – Free Solar Panel: छत पर लगवाएं मुफ्त सोलर पैनल और बिजली का बिल बनाएं ‘ना के बराबर

People also ask Sukanya Samriddhi Yojana Calculator in Excel

How is Sukanya samriddhi calculated?

Any investor will deposit the same amount every year. No deposits are made from the 16th year of investment to the 21st year. Therefore, the Sukanya Samriddhi Online Calculator considers the interest for all the previous deposits. The current SSY interest rate for the period of April to June 2023 is pegged at 8%.

What is sukanya 12500 per month?

Sukanya Samriddhi Account Returns: All you need to know

For our calculation, we assume that your investment will fetch 8% for the entire tenure of 21 years. Suppose you invest Rs 1.5 lakh in SSY every year (or Rs 12,500 per month) for 15 years and your daughter will get around Rs 70 lakh at maturity after 21 years.

What is Sukanya Yojana 1000 per month?

What is Sukanya 1000 per month? Sukanya Samriddhi Yojana (SSY) is a government scheme in India specifically designed to help you save for your girl child’s future.

How to calculate interest rate?

To calculate interest rates, use the formula: Interest = Principal × Rate × Tenure. This equation helps determine the interest rate on investments or loans.

Is Sukanya tax-free?

Tax Benefits: Investments made in the sukanya yojana are eligible for a tax deduction. You can claim a deduction upto Rs 1.5 lakh under section 80C. Also, interest earned and maturity amount are also exempt for tax purposes.

Conclusion

The Sukanya Samriddhi Yojana is a fantastic way to secure the future of a girl child. By using a Sukanya Samriddhi Yojana calculator in Excel, you can easily track your investment and plan for the future. The calculator not only helps you visualize the growth of your investment but also allows you to make informed decisions regarding contributions, interest rates, and other factors.

Using Excel for SSY calculations ensures accuracy, flexibility, and ease of use. Whether you are a first-time investor or someone who has been contributing for a while, having a detailed and well-organized calculation sheet can make managing your investment much easier. So, start using the Sukanya Samriddhi Yojana calculator in Excel today and secure your girl child’s future with confidence.